Maximizing Your Home Buying Potential: A Comprehensive Consider Jumbo Car Loan Financing Options

Navigating the intricacies of big lending funding can dramatically boost your home acquiring prospective, particularly for high-value residential or commercial properties that exceed standard funding limitations. Comprehending the qualification demands, including the requirement for a durable credit report and significant deposit, is crucial for possible customers (jumbo loan). The competitive landscape of interest prices and linked charges tests both provides and chances. As you consider these factors, the inquiry stays: how can you strategically position on your own to make the most of these funding choices while minimizing risks?

Understanding Jumbo Lendings

In the world of home loan financing, big car loans offer as an essential choice for debtors seeking to acquire high-value residential or commercial properties that exceed the adapting lending restrictions set by government-sponsored business. Commonly, these limits vary by area and are established yearly, commonly mirroring the local housing market's characteristics. Big car loans are not backed by Fannie Mae or Freddie Mac, which identifies them from standard car loans and presents different underwriting requirements.

These financings typically include higher rates of interest due to the viewed risk connected with larger lending amounts. Customers that go with big funding typically need an extra considerable financial profile, including higher credit history and reduced debt-to-income proportions. In addition, jumbo loans can be structured as fixed-rate or adjustable-rate home mortgages, enabling debtors to choose a repayment plan that aligns with their economic objectives.

The value of big finances expands beyond simple financing; they play a critical role in the luxury actual estate market, making it possible for purchasers to obtain properties that stand for substantial financial investments. As the landscape of mortgage options advances, recognizing jumbo car loans becomes crucial for browsing the complexities of high-value building acquisitions.

Qualification Needs

To get a big car loan, debtors should meet details eligibility requirements that vary from those of conventional funding. One of the primary standards is a higher credit rating, typically calling for a minimum of 700. Lenders examine creditworthiness rigorously, as the increased car loan quantities involve higher risk.

Furthermore, jumbo car loan candidates normally require to provide evidence of significant earnings. Numerous loan providers choose a debt-to-income proportion (DTI) of 43% or reduced, although some may enable as much as 50% under certain circumstances. This makes certain consumers can manage their monthly settlements without economic stress.

Furthermore, significant possessions or reserves are frequently called for. Lenders may request for at the very least six months' worth of home loan settlements in liquid possessions, showing the borrower's ability to cover costs in situation of revenue disturbance.

Last but not least, a bigger down repayment is traditional for jumbo loans, with numerous lending institutions expecting at the very least 20% of the purchase rate. This demand alleviates risk for loan providers and indicates the consumer's commitment to the financial investment. Satisfying these stringent eligibility standards is vital for securing a big car loan and successfully navigating the high-end genuine estate market.

Rate Of Interest and Costs

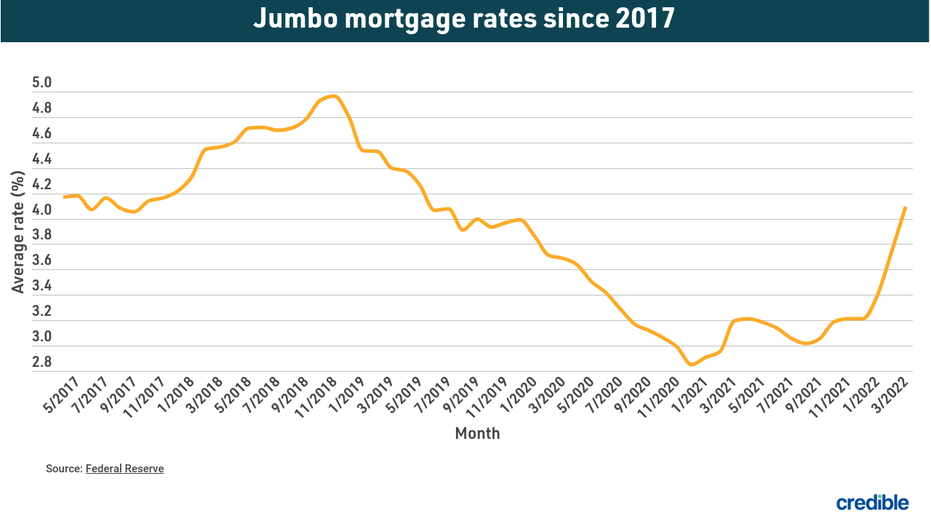

Understanding the ins and outs of rates of interest and costs connected with jumbo fundings is important for prospective consumers. Unlike adjusting lendings, jumbo fundings, which exceed the adhering car loan restrictions established by Fannie Mae and Freddie Mac, commonly featured higher rate of interest. This rise is attributable to the viewed risk lending institutions take on in moneying these larger car loans, as they are not backed by government-sponsored enterprises.

Rates of interest can vary considerably based upon several factors, including the customer's credit scores score, the loan-to-value ratio, and market conditions. It is vital for debtors to look around, as various loan providers may offer varying terms and prices. In addition, jumbo loans may include greater fees, such as origination fees, appraisal fees, and private mortgage insurance (PMI) if the deposit is less than 20%.

To minimize costs, borrowers should very carefully examine the cost frameworks of different lending institutions, as some may provide lower rate of interest rates yet greater costs, while others may supply a much more balanced approach. Ultimately, comprehending these elements aids customers make notified decisions and optimize their funding choices when obtaining luxury residential properties.

Benefits of Jumbo Fundings

Jumbo fundings offer substantial benefits for buyers looking for to buy high-value homes. One of the primary benefits is that they give access to funding that surpasses the conforming car loan restrictions set by the Federal Real Estate Financing Firm (FHFA) This allows customers to safeguard bigger car loan quantities, making it possible to obtain elegant homes or residential or commercial properties in very popular areas.

Additionally, jumbo lendings commonly come with competitive rate of interest, specifically for borrowers with strong debt profiles. This can lead to significant savings over the life of the funding. Jumbo car loans typically enable for a selection of finance terms and structures, providing versatility to customize the financing to fit private monetary circumstances and lasting objectives.

An additional trick benefit is the potential for lower down repayment needs, depending on the lender and customer credentials. This enables customers to enter the premium realty market without requiring to devote a considerable in advance capital.

Lastly, jumbo financings can provide the opportunity for higher cash-out refinances, which can be advantageous for property owners seeking to use their equity for significant costs or various other investments - jumbo loan. In general, jumbo car loans can be an efficient tool for those navigating Bonuses the upper echelons of the housing try this web-site market

Tips for Getting Funding

Safeguarding financing for a jumbo lending calls for careful prep work and a critical strategy, specifically provided the distinct features of these high-value mortgages. Begin by assessing your economic health; a durable credit report, usually over 700, is vital. Lenders sight this as an indication of reliability, which is essential for jumbo loans that surpass conforming financing restrictions.

Involving with a home mortgage broker experienced in big financings can give valuable understandings and accessibility to a broader variety of loaning choices. They can assist navigate the complexities of the approval procedure, guaranteeing you locate affordable rates. Finally, be prepared for a more strenuous underwriting procedure, which might include additional analysis of your monetary background. By following these tips, you can improve your opportunities of efficiently protecting financing for your big funding.

Conclusion

In final thought, big car loans supply unique advantages for buyers seeking high-value buildings, offered they fulfill particular qualification criteria. With demands such as a solid credit history rating, reduced debt-to-income ratio, and significant deposits, prospective home owners can access deluxe realty opportunities. By comparing rate of interest and working together with knowledgeable home mortgage brokers, people can enhance their home purchasing prospective and make notified monetary choices in the competitive genuine estate market.

Navigating the complexities of big funding financing can considerably enhance your home buying possible, especially for high-value homes that exceed standard finance restrictions.In the realm of home mortgage financing, jumbo fundings serve as a critical alternative for debtors seeking to purchase high-value homes visit this page that exceed the adjusting financing limitations set by government-sponsored enterprises. Unlike adhering car loans, big fundings, which exceed the adjusting funding limits set by Fannie Mae and Freddie Mac, typically come with higher passion rates. Big lendings commonly allow for a variety of financing terms and structures, supplying flexibility to customize the financing to fit individual financial circumstances and lasting goals.

Lenders sight this as a sign of integrity, which is vital for big lendings that surpass adjusting funding restrictions. (jumbo loan)

Comments on “Jumbo Loan: Affordable Rates and Flexible Terms for Pricey Features”